Mortgage Rates Hit a 3-Year Low: What This Means for Your Real Estate Business

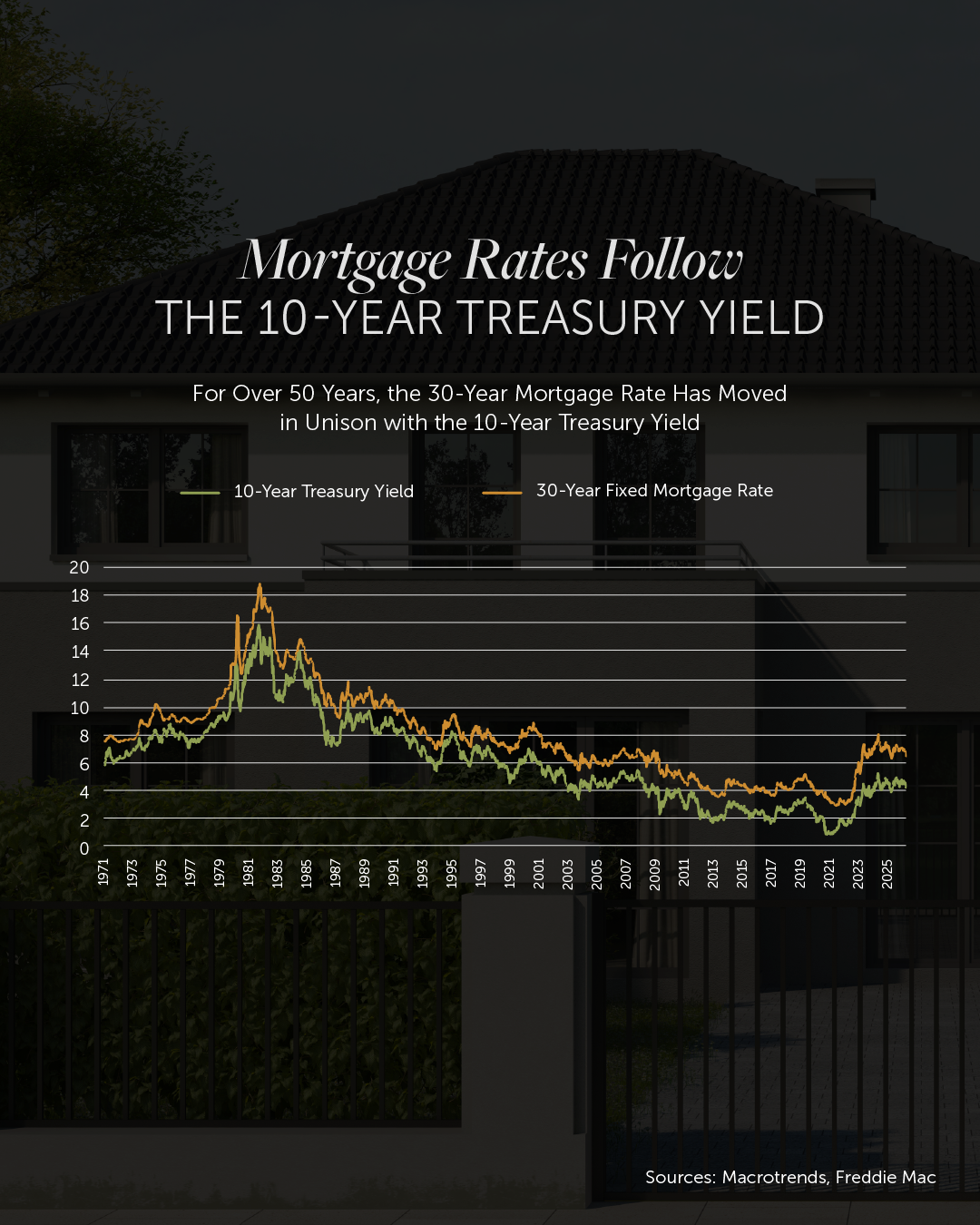

In an evolving housing market, every shift in mortgage rates carries significant implications—not just for homebuyers, but for the entire real estate and lending ecosystem. With mortgage rates recently revisiting territory in the low 6% (and, briefly, the high 5% range) for the first time in three years, now is a key moment for industry professionals to regroup, recalibrate, and engage their client base.