QRL Financial Services: Your One-Stop Solution for Comprehensive Residential Mortgage Services

QRL Financial Services offers a wide range of residential mortgage services tailored to meet the specific needs of banks and credit unions.

QRL Financial Services offers a wide range of residential mortgage services tailored to meet the specific needs of banks and credit unions.

The recent d ownward trend in mortgage rates is benefiting homebuyers in more ways than one. Not only does it improve affordability, but it also has the potential to inspire more homeowners to put their houses up for sale.

ownward trend in mortgage rates is benefiting homebuyers in more ways than one. Not only does it improve affordability, but it also has the potential to inspire more homeowners to put their houses up for sale.

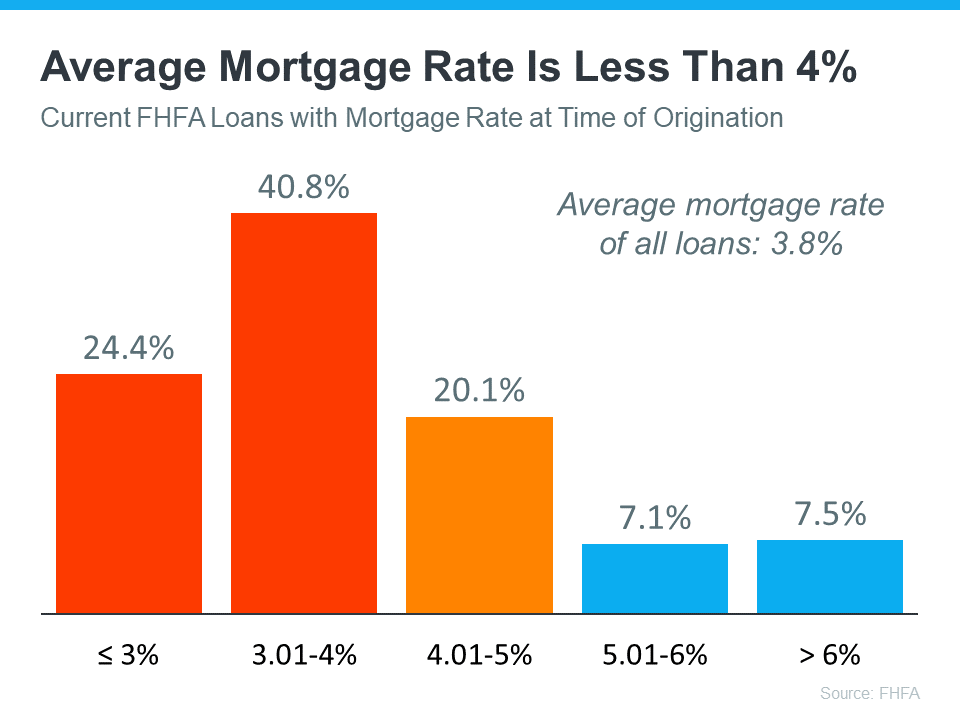

In the past year, the limited housing supply has been a challenge for homebuyers. Many homeowners chose to delay selling their homes when mortgage rates increased. They opted to keep their current lower mortgage rate instead of moving and taking on a higher rate on their next home. This created a shortage of available homes on the market.

However, early signs indicate that these homeowners are now ready to make a move. According to data from Realtor.com, there was an increase in new listings in December 2023 compared to December 2022. Typically, housing market activity slows down towards the end of the year as sellers delay their moves until the new year. This is the first time since 2020 that an upward trend in new listings has been observed during this time of year. It suggests that the rate lock-in effect is easing in response to lower rates.

Since  their introduction in 1944, mortgages backed by the Department of Veterans Affairs (VA) have enabled millions of veterans and active-duty military to buy a home without a large down payment. While VA loans weren't always easy to underwrite, the process has seen major improvements over the past ten years.

their introduction in 1944, mortgages backed by the Department of Veterans Affairs (VA) have enabled millions of veterans and active-duty military to buy a home without a large down payment. While VA loans weren't always easy to underwrite, the process has seen major improvements over the past ten years.

According to the latest data from Fannie Mae, 23% of Americans still think home prices will go down over the next twelve months. But why do roughly 1 in 4 people feel that way?

During the fourth quarter of last year, some housing experts projected home prices were going to crash in 2023. The media ran with those forecasts and put out headlines calling for doom and gloom in the housing market. All of this negative news coverage made a lot of people have doubts about the strength of the residential real estate market.

Have you ever wondered how inflation impacts the housing market? Believe it or not, they’re connected. Whenever there are changes to one, both are affected. Here’s a high-level overview of the connection between the two.

The biggest challenge the housing market’s facing is how few homes there are for sale. Mark Fleming, Chief Economist atFirst American,explainsthe root causes of...